Support Us

Interested in supporting our priorities?

Advocacy Priorities

Closing the Credit Gap

- RBFC funder companies are crucial in closing the credit gap by helping small businesses receive flexible financing options. Small businesses face numerous challenges and take significant risks to succeed. Traditional bank financing cannot meet the needs of the marketplace, leaving a gap in credit availability for small to medium-sized businesses.

RBF Transactions Are Not Loans

- RBF transactions involve the purchase of future receivables, similar to factoring transactions. There is no compounding interest or repayment due date. The product is not a loan.

APR Disclosure Doesn’t Fit RBF Products

- Requiring RBF providers to calculate and disclose an annual percentage rate (APR) in a standard agreement is not appropriate for RBF products. APR disclosure requires knowing when the receivables will be fully acquired, which could vary from one month to six months or longer, depending on the business’s revenue stream.

- Without compounding interest rates, the cost of capital remains the same regardless of the agreement’s duration.

- APR is suitable for consumer lending products like credit cards or mortgages that accrue interest yearly and have a set repayment period. However, it is not useful for products with a fixed cost of financing and no set repayment period.

Total Cost of Capital (TCC) Standard

- TCC is the industry standard for disclosures, allowing businesses to understand exactly how much they will repay the funder over the entire agreement duration. We advocate for policies that facilitate keeping more financing options available to small businesses, not less. The TCC disclosure approach includes:

- Total amount of funds provided: The total amount of funds provided to businesses under the terms of the financing.

- Total amount of funds disbursed: The total amount of funds disbursed to the business if less than the total amount provided.

- Total of payments: The total amount the business will pay.

- Total dollar cost of financing: The total dollar cost of the financing.

- Payments: The manner, frequency, and amount of each payment.

- Prepayment: A statement of whether there are any costs or discounts associated with prepayment.

Promoting Responsible Regulation and Compliance

- The industry is committed to principles that promote transparency, fairness, strong risk management, and security.

- RBFC monitors state and federal regulations, such as the CFPB’s 1071 Small Business Data Collection Rule, to help member companies stay compliant and current on recent updates and developments.

- We advocate for policies that facilitate keeping more financing options available to small businesses.

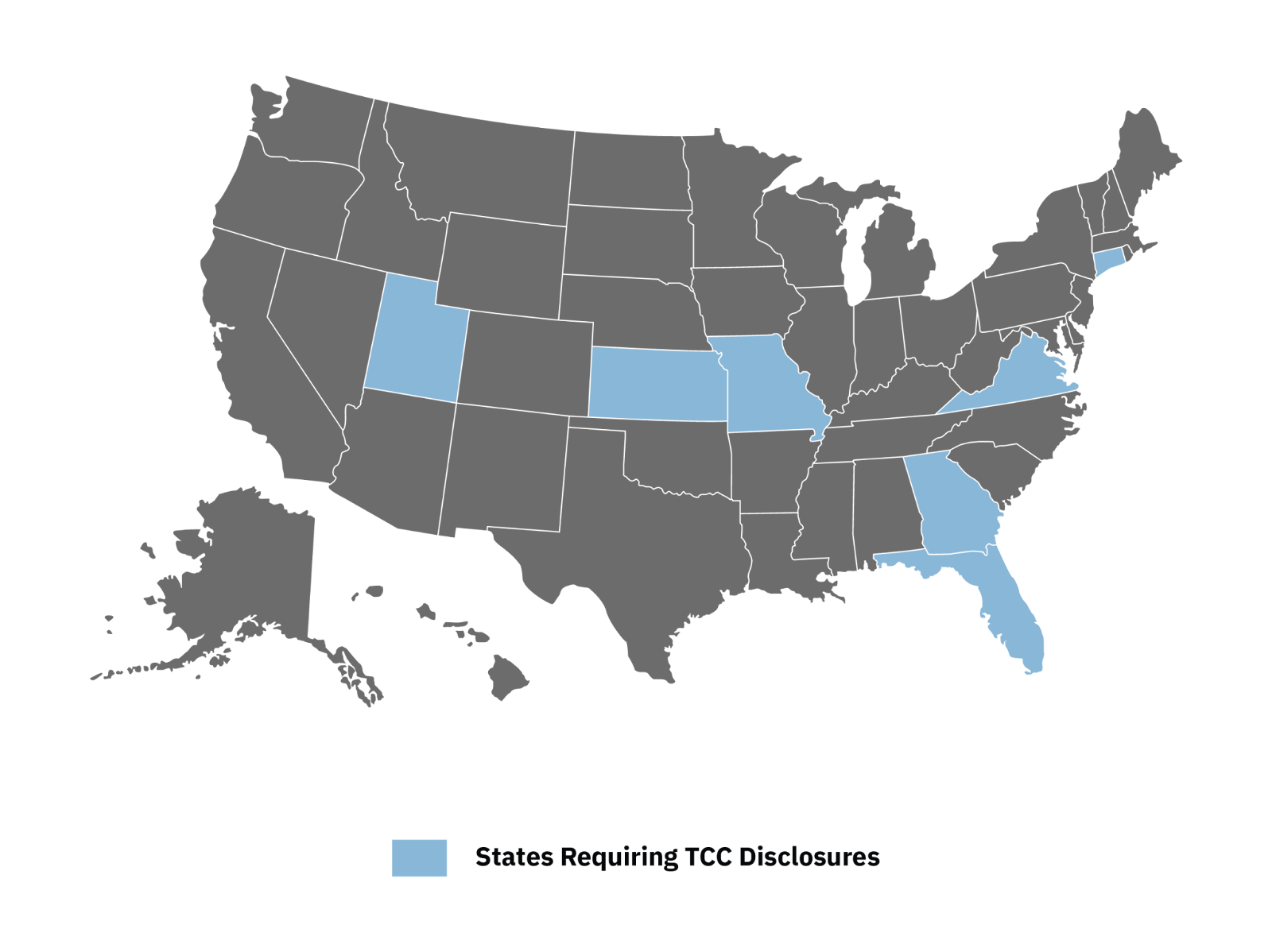

These states have adopted the TCC model, setting a standard for clear and reliable financing disclosures. As more states consider this approach, maintaining precise and accurate standards is essential to ensure that business owners receive transparent information without estimates that could mislead their financial decisions.

†Revenue Based Finance Coalition, Inc. PAC (the “RBFC PAC”) is a separate segregated fund comprised of voluntary, after-tax contributors from the company’s eligible employees, stockholders, and their immediate family members. The PAC supports political candidates who further RBFC’s policy goals through direct involvement in federal elections. This is accomplished through educating our members on the importance of being involved in the political process via financial support of candidates for federal office.

Contributions to the RBFC PAC are strictly voluntary and you have the right to refuse to contribute without reprisal or other adverse effects. Any suggested contribution amounts are merely suggestions, and you may contribute more or less. RBFC will not favor or disadvantage anyone by reason of the amount contributed or the decision whether to contribute.

The maximum amount an individual may contribute to the PAC is a total of $5,000 per calendar year. Contributions from foreign nationals are prohibited.

Federal law requires the PAC to use its best efforts to collect and report the name, address, occupation, and employer of any individual whose total contributions exceed $200 per calendar year. Federal law also mandates that the PAC may only accept contributions from U.S. citizens or permanent green card holders living in the United States.

Contributions are not deductible as charitable contributions.

Contribution rules

- I am a U.S. citizen or lawfully admitted permanent resident (i.e., green card holder).

- This contribution is made from my own funds, and funds are not being provided to me by another person or entity for the purpose of making this contribution.

- I am at least 18 years old.

- I am not a federal contractor.

- I am making this contribution with my own personal credit card and not with a corporate or business credit card or a card issued to another person.